They may also include asset write-offs or write-downs, which often suggest that management may have paid too much for a particular asset or invested too much in an unprofitable business. Also, they frequently include items such as restructuring charges, which are costs incurred to close a factory or lay off part of the workforce, for example. Some companies abuse these "one-time" accounting events to the point where they become annual events. Often, nonrecurring costs or accounting gains are included here. Other operating expenses represent all other expenses related to a company's primary operations not included in the above categories. For more information about noncash revenue and expenses, read the section on accrual accounting later in this lesson. It is worth noting that depreciation and amortization expenses are noncash expenses. However, the statement of cash flows, one of the other key financial statements, has depreciation and amortization amounts (sometimes combined) disclosed. Oftentimes, depreciation and amortization are already included in the other expenses mentioned above, so you may not see them listed separately on the income statement. This expense represents the building's or equipment's normal wear and tear over time, and is referred to as depreciation expense.Īmortization is similar to depreciation, except amortization relates to intangible assets, or assets that do not have a physical presence, such as a brand name. Instead, the company expenses the asset gradually over the estimated useful life of the asset. When a company purchases an asset that the company intends to use over a period of time, such as a piece of factory equipment or a building, the asset's entire cost isn't immediately expensed on the income statement. Costs related to a company's human resources and finance departments and costs related to its office buildings are examples of general and administrative expenses.ĭepreciation and Amortization. General and administrative expenses, meanwhile, represent most overhead costs of operating a company's business. Examples include marketing expenses and compensation for sales staff. Selling expenses are those expenses incurred in attempting to create sales for the company. Selling, general, and administrative expenses (also known as "SG&A") consist of several types of costs. Selling, General, and Administrative Expenses.

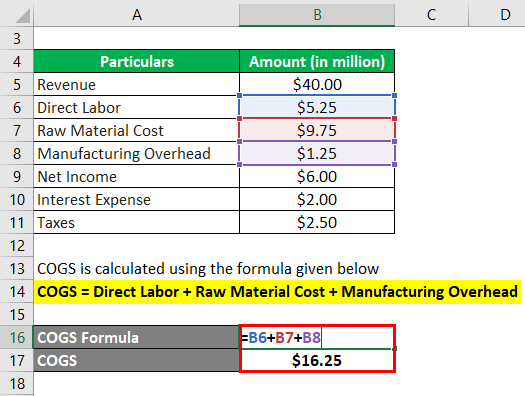

The steel and rubber Harley-Davidson HOG had to purchase to make its motorcycles would also be grouped into cost of sales. If it cost Best Buy $9 to acquire the DVD that you purchased, that $9 is considered a cost of sales. Examples include raw materials, items purchased for resale, the cost of running a factory, and labor.

Cost of sales (also known as cost of goods sold-COGS-or cost of services) represents all of the expenses directly incurred in creating the goods or services that a company sells. Companies' expenses are usually grouped into similar categories.Ĭost of Sales. A company needs to spend money to make money, and these outflows from making and selling its products or providing and selling its services represent a company's expenses.

0 kommentar(er)

0 kommentar(er)